In the meantime the FCA, in line with its consumer protection objective, is being proactive at the boundaries of the FCA perimeter. The FCA engaged with four BNPL firms, who ‘voluntarily’ agreed to change terms in their consumer contracts to make them fairer, easier for consumers to understand and to better reflect how they use them in practice.

So what terms raised concerns for the FCA?

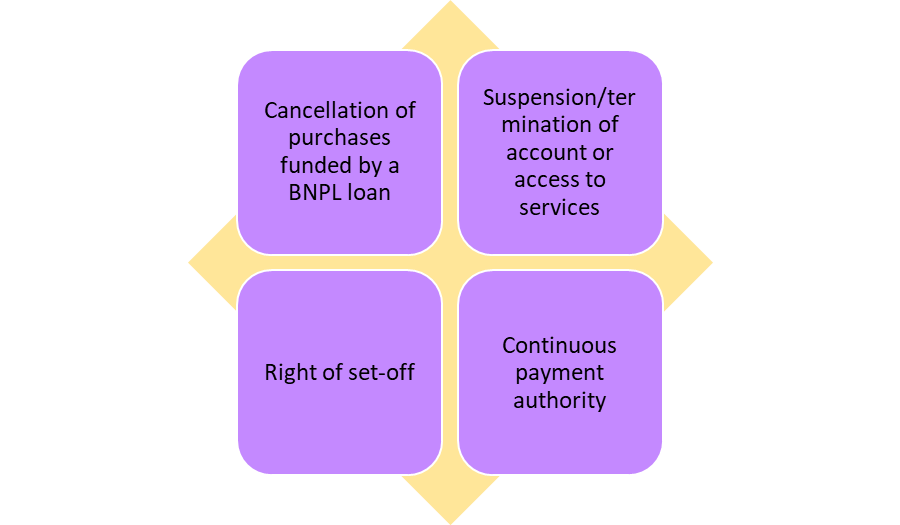

The FCA was concerned to make sure that the terms of BNPL credit agreements meet the fairness and transparency requirements of sections 62 and 68 of the Consumer Rights Act 2015 (CRA), although the FCA acknowledged that ultimately only a court can determine a term’s fairness and/or transparency.The FCA provided guidance to firms generally concerning four types of terms:

The FCA advised firms to consider the following when drafting their contract terms.

Cancellation:

- take into account the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013 (CCRs), in particular the cancellation provisions including regulation 38(1).

- clearly set out the timing and how they will process the refunds (fully and partially) when the consumer cancels and/or returns goods to the retaile

- consider including any facility they provide to consumers to pause or suspend payments, in situations where the consumer cancels or returns goods, as a contractual right

Suspension or termination:

- make it clear when they will provide advance notice to consumers if they intend to terminate and/or suspend a consumer’s account or access to services

- explain the very limited circumstances when they might terminate and/or suspend a consumer’s account or access to services without giving advance notice, ensuring these circumstances are fair and reasonable (for example, due to suspicious activity)

- make it clear to consumers what the consequences are if they terminate/suspend a consumer’s account and ensure those consequences are reasonable (this includes consumers not being subject to more onerous payment terms where the firm terminates the contract without any fault on the consumer’s part)

Right of set-off:

- Consumers must be able to offset/deduct money owed to them by the firm from instalments.

Continuous payment authority:

- make it clear how a consumer can cancel their continuous payment authority and what impact this has on any outstanding payments due.

More generally, the FCA wants firms to ensure that their consumer contracts comply with all requirements of consumer protection legislation that apply to their business, including ALL of the CRA (and corresponding requirements under the Unfair Terms in Consumer Contracts Regulations 1999 for contracts entered into between 1 July 1995 and 30 September 2015, those Regs then having been subsumed within the CRA from 2015).

The FCA also expects firms that charge late payment fees should review the circumstances in which they have previously charged these fees to consumers for not paying instalments after the loan agreement should have been terminated and provide swift redress for any fees inappropriately charged.

Giving consumers flexibility as to how and when to pay is now common place, but the FCA message here is crystal clear. It's also important, more generally, to ensure that the 'transparency' and 'prominence' requirements are fulfilled within the whole consumer sales journey - burying key terms in the Ts & Cs (or late in the consumer sales journey) just won't cut it with the UK regulators, whether the FCA, Trading Standards or the CMA.